The Greatest Guide To Estate Planning Attorney

The Greatest Guide To Estate Planning Attorney

Blog Article

The 15-Second Trick For Estate Planning Attorney

Table of ContentsThe 30-Second Trick For Estate Planning AttorneyThe Best Strategy To Use For Estate Planning AttorneySome Ideas on Estate Planning Attorney You Need To KnowSee This Report on Estate Planning Attorney

Your lawyer will certainly likewise help you make your documents authorities, scheduling witnesses and notary public trademarks as needed, so you do not have to fret about trying to do that final action on your own - Estate Planning Attorney. Last, but not least, there is important tranquility of mind in developing a relationship with an estate preparation attorney that can be there for you down the roadwayPut simply, estate preparation lawyers provide value in lots of methods, much beyond simply supplying you with printed wills, counts on, or other estate preparing records. If you have inquiries concerning the process and desire to find out more, contact our workplace today.

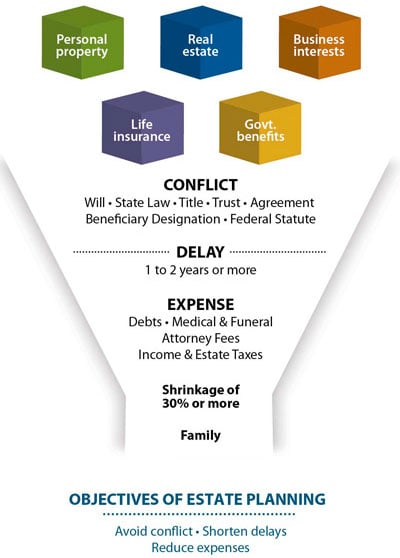

An estate planning attorney assists you define end-of-life decisions and legal documents. They can set up wills, develop trust funds, create healthcare directives, develop power of attorney, create sequence strategies, and much more, according to your desires. Functioning with an estate preparation attorney to finish and supervise this legal documents can aid you in the following 8 locations: Estate intending attorneys are specialists in your state's count on, probate, and tax obligation legislations.

If you do not have a will, the state can determine just how to divide your possessions amongst your beneficiaries, which may not be according to your desires. An estate preparation lawyer can assist organize all your legal files and distribute your possessions as you wish, possibly staying clear of probate. Lots of people draft estate planning records and afterwards neglect about them.

6 Easy Facts About Estate Planning Attorney Shown

As soon as a client dies, an estate strategy would certainly determine the dispersal of assets per the deceased's directions. Estate Planning Attorney. Without an estate strategy, these choices might be left to the following of kin or the state. Duties of estate organizers include: Producing a last will and testament Establishing trust accounts Calling an administrator and power of attorneys Identifying all beneficiaries Calling a guardian for minor kids Paying all debts and reducing all taxes and legal fees Crafting guidelines for passing your values Developing choices for funeral plans Completing guidelines for care if you become unwell and are unable to choose Getting life insurance policy, handicap earnings insurance policy, and lasting treatment insurance A good estate strategy ought to be updated routinely as clients' economic scenarios, individual motivations, and government and state laws all progress

Just like Visit This Link any type of career, there are characteristics and abilities that can assist you accomplish these objectives as you collaborate with your customers in an estate planner role. An estate preparation job can be best for you if you have the complying with traits: Being an estate coordinator suggests thinking in the lengthy term.

The Of Estate Planning Attorney

You must help your customer expect his or her end of life and what will happen postmortem, while at the very same time not house on dark ideas or emotions. Some clients may become bitter or distraught when contemplating death and it might drop to you to help them via it.

In the event of death, you might be anticipated to have countless discussions and transactions with enduring relative concerning the estate plan. In order to excel as an click for more info estate organizer, you might require to stroll a fine line of being a shoulder to lean on and the individual depended helpful resources on to communicate estate preparation issues in a timely and specialist fashion.

Expect that it has been modified better because then. Depending on your client's economic earnings brace, which might progress towards end-of-life, you as an estate coordinator will certainly have to maintain your customer's possessions in full legal conformity with any kind of regional, federal, or global tax legislations.

Get This Report on Estate Planning Attorney

Acquiring this accreditation from organizations like the National Institute of Qualified Estate Planners, Inc. can be a strong differentiator. Belonging to these professional groups can confirm your abilities, making you much more eye-catching in the eyes of a possible client. In enhancement to the emotional benefit helpful clients with end-of-life planning, estate coordinators appreciate the advantages of a stable earnings.

Estate preparation is a smart thing to do no matter your current health and wellness and monetary standing. Not so many individuals understand where to start the process. The initial vital thing is to work with an estate planning attorney to assist you with it. The complying with are 5 advantages of functioning with an estate planning attorney.

A seasoned lawyer knows what info to include in the will, including your beneficiaries and unique considerations. It likewise supplies the swiftest and most effective approach to move your possessions to your beneficiaries.

Report this page